Did you know?

ChinaBio® Group is a consulting and advisory firm helping life science companies and investors achieve success in China. ChinaBio works with U.S., European and APAC companies and investors seeking partnerships, acquisitions, novel technologies and funding in China.

Free Newsletter

Have the latest stories on China's life science industry delivered to your inbox daily or weekly - free!

Free Report

Featured Company: HD Biosciences Receives Pfizer’s Top Partner Award

HD Biosciences Co., Ltd. (HDB), the Shanghai-based biotech CRO, was given the “2008 Top Research Service Partner” award by multinational big pharma Pfizer (NYSE: PFE). The award was given to recognize the quality, productivity, and value that HD Biosciences delivered in its collaboration with Pfizer during the past year.

“We are thrilled by this recognition from Pfizer,” said Dr. Xuehai Tan, founder and CEO of HDB in a statement. “The award reflects the commitment from both sides at the very beginning of the collaboration to build a long-term productive and rewarding relationship.”

HD Biosciences has been providing biology discovery services to multiple Pfizer research sites including Groton, La Jolla, USA, and Sandwich, UK. The services range from assay development and validation, to plate based screening in both cell-based and biochemical assay formats.

Because of its recognition of HDB as a quality service provider and an emerging player in the R&D service space, Pfizer made an equity investment in HDB in August 2008.

HDB offers a broad range of services in a high-throughput setting for plate-based pharmacology and compound profiling, including but not limited to GPCR, ion channel, kinase profiling,. It is expanding by adding in vitro/in vivo DMPK and animal disease models research areas.

HD Biosciences Background and Interview with Founder Dr. Xuehai Tan

HD Biosciences is focused entirely on biology service in drug development, a fairly unusual niche that differentiates the company from most China CROs, which concentrate on medicinal chemistry services. “We stay focused on the things we do the best,” said Xuehai Tan, PhD, founder and CEO of the company in an exclusive interview with ChinaBio® Today. “We will not try to do everything. But, we are the leaders in what we do.”

Dr. Tan may be the quintessential sea turtle. He spent 16 years in the US, first getting his PhD and then working for a number of US biopharmas. His last US-based job was at Aurora Biosciences, a significant post for him, because the company produced drug development tools, including fluorescent assay technologies and ultra-high-throughput screening systems. These areas later became central to HD Biosciences. Aurora was sold in 2001 to Vertex Pharmaceutical (NSDQ: VRTX), and Dr. Tan returned to China.

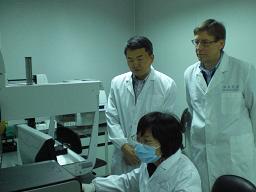

Figure 1. Xuehai Tan, PhD, founder and CEO of HD Biosciences

In China, Tan landed at the Beijing Genomic Center, where he served as Head of Drug Discovery. The Beijing Genomic Center was a non-profit organization. Given Tan’s background in the pharmaceutical industry, he thought the center could do a better job of developing drugs if it adopted a more western model. “In my opinion, if you want to perform biotechnology, you can’t rely on government,” he declared. “The situation is no different in China than it is in the US or Europe. If someone wants to market a technology, he needs to have a private company.”

Out of the Beijing Genomic Center, HD Biosciences was formed in 2002. At the outset, HD Biosciences sought to identify lead compounds derived from TCM ingredients. But as time went on, the company morphed into a CRO that provides biology focused contract research services.

In its seven years of operation, the company has grown to the point where it currently employs 100 professionals who do the biology work. It has partnered with six of top 10 big pharmas in the world, including Pfizer and Organon Biosciences, and it also counts more than 10 medium-sized biotechs as clients.

For Dr. Tan, the attractiveness of China CROs starts with its cost effectiveness. “The China CRO industry is helping the pharmaceutical industry at a time when it is trying to develop a more efficient way of operating. China CROs are significantly less expensive than similar services in the US, and will remain so for at least 5 to 10 years.” Beyond that, Tan says, the cost advantage will remain, though no one knows for sure how much the world will change that far in the future.

However, China CROs now offer more than savings alone. “There has been an increase in expertise,” he declared. “This makes China more attractive. We have lots of talent coming back from overseas, and we can offer quality that is very comparable to the US. China can provide the same quality of service with faster turnaround time.”

Tan admits that, at present, not all the CRO work performed in China is accepted by the FDA. Nevertheless, he says “Progress is being made.” Tan believes that, gradually, acceptance levels will increase. The placement of FDA inspectors in China is a big step forward that will improve cooperation. “Five years from now,” he said, “you will see more and more compounds whose pre-clinical work has been done in China accepted for IND in the States.”

The economic logic of China CROs means that more CRO competitors will open their doors, challenging established companies like HD Bioscience. Still, as Tan points out, China has only a 10% share of the worldwide CRO market. Staying power for any individual entity will depend on what it brings to the table. “For us, we have built our own expertise, built our IP, and built our in-house knowhow,” he said.

Emphasizing his company’s overall strength is Tan’s major point when talking to potential clients. “We position ourselves as the clear leader in biology service. We approach clients showing our in-house knowledge and our accomplishments. We have built a large team. Many of them were returnees who have big pharma experience, so they understand the standards that big pharma expects. Because we focus on internal development, we can offer input that clients may not have. We can demonstrate our procedures. A lot of work has gone into SOPs and project management that we can show to clients, indicating our level of quality.”

Funding

The company Tan founded has attracted first-rank attention. In August of 2008, HD Biosciences announced it closed its Series A funding, with participation by heavy hitting venture capitalists including Morningside Venture (who led the round), Lilly Asian Ventures and Pfizer Venture Investments. The funding may be the first time that multiple big pharmas took equity positions in a China-based CRO.

The investment was initially announced at the ChinaBio® Investor Forum held in July 2008 in Shanghai. Initial interest in HD Biosciences may have been piqued at an earlier event, the ChinaBio Investor Forum held in Shanghai in December 2007. HD Biosciences was one of 15 companies that presented to potential investors at that event. Both Dr. Yi Shi of Lilly and Dr. Wayne Li of Morningside were in attendance. Dr. Shi and Dr. Li also participated with Dr. Tan on a panel called "Funding Success Stories" at the July 2008 Investor Forum.

Growth

Growth has allowed the company to open a second office in Shanghai’s Zhangjiang Hi-Tech Park. The company has leased new space in the East section of the park, refurbished the building, and now sites its major operations in its new lab space. Some work remains at the old facility, located in the West part of the park. Meanwhile, its Beijing lab is a legacy from the Beijing Genome Center. It has P3 certification, which means it meets the safety standards that allow the investigation of infectious agents.

Figure 2. Xuehai Tan and Greg Scott, Executive Editor of China BioToday(r), at one of HD Biosciences' high throughput analyzers

Because HD Biosciences does not want to dilute the purity of its mission, it also joined the CRO Service Alliance of Shanghai so that it could outsource any chemistry work (and receive any biology work from its partners). CROSA includes the CRO Sundia MediTech (together with its subsidiary United PharmaTech) and several other organizations.

Summary

By joining CROSA, HD Biosciences can stick to its biological CRO niche, avoiding the distraction of attempting to be everything for everyone. The focused approach seems to be working for HD Biosciences, a fact with which Pfizer seems to agree.

See our other articles on HD Biosciences.

Disclosure: none.

ChinaBio® News

Greg Scott Interviewed at BIO-Europe Spring

How to bring your China assets to China in 8 minutes

"Mr. Bio in China."

Mendelspod Interview

Multinational pharma held to a higher standard in China