Did you know?

ChinaBio® Group is a consulting and advisory firm helping life science companies and investors achieve success in China. ChinaBio works with U.S., European and APAC companies and investors seeking partnerships, acquisitions, novel technologies and funding in China.

Free Newsletter

Have the latest stories on China's life science industry delivered to your inbox daily or weekly - free!

Free Report

SFDA Annual Report of Drug Registration Approvals -- 2010

publication date: Oct 21, 2011

|

author/source: Tao Zhang and Richard Daverman, PhD

The SFDA has released a concise summary of its registration approvals last year, showing, to nobody's surprise, that China's pharmaceutical scene is active -- the number of approvals numbered exactly 1,000. To make the data more useful, we have broken it down using various metrics, presenting, for example, the totals by type of drug (chemical, TCM, biologic), the number of clinical trials approved, and the number of registration applications that were submitted. All of the data is contained in the following eight tables.

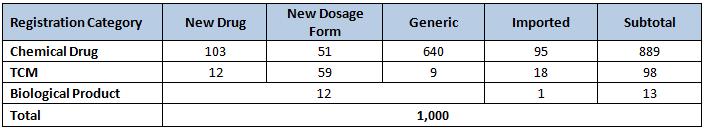

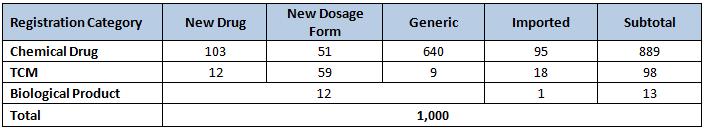

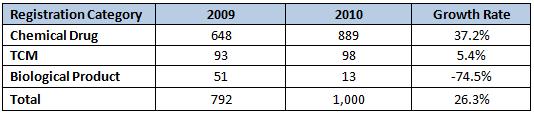

Drug Registration Approval

In 2010, the SFDA approved registration of 1,000 drugs, a remarkably round number. Generic drugs made up the majority of these – 640 in all. Domestic drugs received 886 registrations while the remaining 114 were imported. Most of the registrations were chemical drugs (88.9%), followed by TCM (9.8%) and a token number of biological products (1.3%). Antibiotics comprise 6 of the top 10 varieties by approval volume. And, showing some momentum for the future, the number of drug registrations approved in 2010 was 26.3% higher than 2009’s total.

In 2010, 32 novel compounds were approved for clinical trials and 158 multicenter clinical trials were approved, compared with 132 multicenter clinical trials in 2009.

In the following table, a "New Drug" means a drug that is new to China. It is not necessarily a novel drug on the global scene, which is known in China as a Class 1 drug. To the best of our knowledge (Class I drugs weren't identified as a separate category in the SFDA report), there was only Class 1 approval last year.

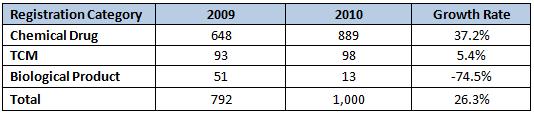

The number of registration approvals climbed 37.2% over 2009. All categories were higher except for biologic drugs, which dropped an astonishing 74.5%, falling from 51 to in 2009 to just 13 in 2010. Even though the relatively small numbers make large percentage swings possible, the size of the falloff remains a surprise.

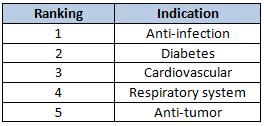

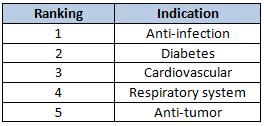

Indications of Approved Drugs

Antibiotics represented six of the top drugs in China approvals during 2010, so it is almost a given that the Anti-infection sector would be the top indication. Diabetes, a sector with strong foreign representation, took second place, followed by cariovascular, respiratory and cancer drugs.

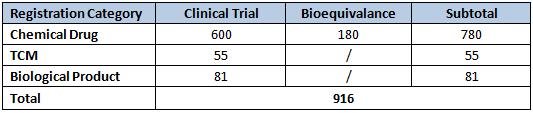

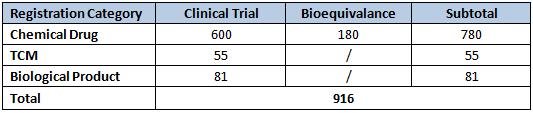

Clinical Studies

A total of 916 requests for clinical trials were approved in 2010. Once again, chemical drugs led the rankings by a large amount with 85.2% of the total. This time, biologics came in second with an 8.8% slice of the pie, and TCMs took third at 6%.

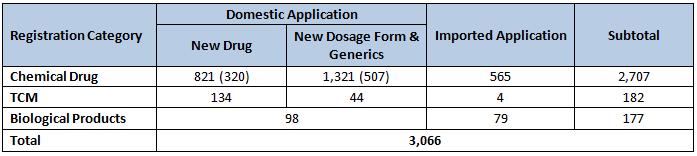

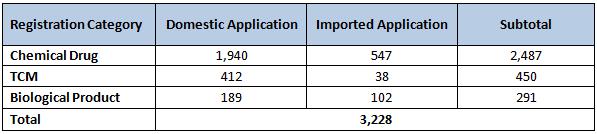

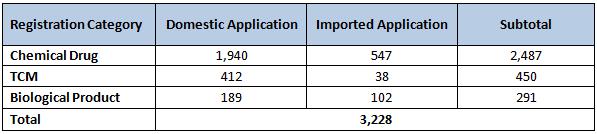

Applications for Drug Registration

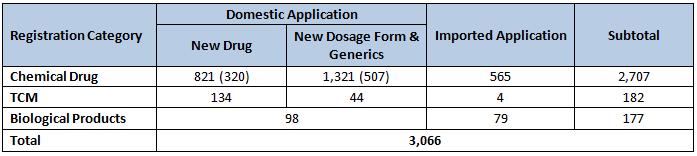

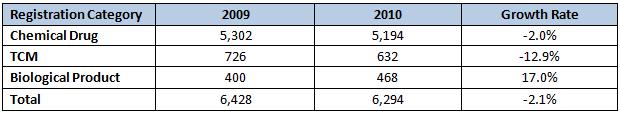

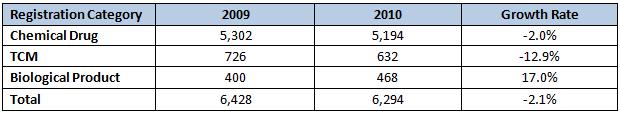

In 2010, 6,294 registration applications were accepted. Out of the total, 3,066 were new registration applications while the remaining 3,228 were supplementary applications*.

Note: Pharmas are required to submit supplementary applications when changes occur such as drug manufacturing process, valid period, origin of the imported drug, etc.

Note: the numbers in the round brackets were calculated based on the number of compounds while the other numbers were based on the number of accepted drug registrations.

Conclusion

Without an analog to the FDA clinical trial database, the SFDA sometimes seems opaque. But the latest report shines a considerable amount of light on the agency's workings. Most importantly, it proves a robust level of activity in the new-to-China drug sector of China biopharma. That bears out the results shown by ChinaBio's research, as well. Now, without wishing to seem too impatient for the future, we would like to seem them break out data for Class 1 drugs as well.

Disclosure: none.

Drug Registration Approval

In 2010, the SFDA approved registration of 1,000 drugs, a remarkably round number. Generic drugs made up the majority of these – 640 in all. Domestic drugs received 886 registrations while the remaining 114 were imported. Most of the registrations were chemical drugs (88.9%), followed by TCM (9.8%) and a token number of biological products (1.3%). Antibiotics comprise 6 of the top 10 varieties by approval volume. And, showing some momentum for the future, the number of drug registrations approved in 2010 was 26.3% higher than 2009’s total.

In 2010, 32 novel compounds were approved for clinical trials and 158 multicenter clinical trials were approved, compared with 132 multicenter clinical trials in 2009.

In the following table, a "New Drug" means a drug that is new to China. It is not necessarily a novel drug on the global scene, which is known in China as a Class 1 drug. To the best of our knowledge (Class I drugs weren't identified as a separate category in the SFDA report), there was only Class 1 approval last year.

Table 1: Registration Approvals in 2010

The number of registration approvals climbed 37.2% over 2009. All categories were higher except for biologic drugs, which dropped an astonishing 74.5%, falling from 51 to in 2009 to just 13 in 2010. Even though the relatively small numbers make large percentage swings possible, the size of the falloff remains a surprise.

Table 2: Comparison of drug registrations approved in 2009 and 2010

Indications of Approved Drugs

Antibiotics represented six of the top drugs in China approvals during 2010, so it is almost a given that the Anti-infection sector would be the top indication. Diabetes, a sector with strong foreign representation, took second place, followed by cariovascular, respiratory and cancer drugs.

Table 3: Top 5 Indications in 2010

Clinical Studies

A total of 916 requests for clinical trials were approved in 2010. Once again, chemical drugs led the rankings by a large amount with 85.2% of the total. This time, biologics came in second with an 8.8% slice of the pie, and TCMs took third at 6%.

Table 4: Clinical Studies Approved in 2010

To give a longer-term perspective on Class 1 drug development -- a proxy

for innovation in China's biopharma sector -- ChinaBio(r) research has

discovered that there were 181 Class 1 drugs in clinical trials during

the period 2004-2010. From these, 28 new drugs were launched

(representing 11 molecules). There are 153 Class 1 drugs currently in

the clinic and 200+ in pre-clinical development. These numbers give

evidence of a strongly rising long-term trend.

ChinaBio research also showed that, during 2004-10, chemical drugs constituted 59% of the total; biologics were 28%; vaccines represented 9% and gene therapies were 2%. In terms of disease targets (2004-10), our research shows oncology drugs comprised 31% of the Class 1 drugs (56 molecules); infectious disease 21% (38 molecules); cerebro-cardiovascular were 13% (23 molecules); endocrine and metabolic were 9% (16 molecules) and immuno-allergy drugs were 8% of the total (15 molecules).

As the chart below shows, 2010's results were up 18.7% over 2009. Chemical drugs and biologic products were both higher, with growth rates in the mid-20% range, but TCMs fell 32.1%.

As the chart below shows, 2010's results were up 18.7% over 2009. Chemical drugs and biologic products were both higher, with growth rates in the mid-20% range, but TCMs fell 32.1%.

Table 5: Comparison of Clinical Studies Approved in 2009 and 2010

Applications for Drug Registration

In 2010, 6,294 registration applications were accepted. Out of the total, 3,066 were new registration applications while the remaining 3,228 were supplementary applications*.

Note: Pharmas are required to submit supplementary applications when changes occur such as drug manufacturing process, valid period, origin of the imported drug, etc.

Table 6: New Registration Applications in 2010

Note: the numbers in the round brackets were calculated based on the number of compounds while the other numbers were based on the number of accepted drug registrations.

Table 7: Supplementary Registration Applications in 2010

Table 8: Comparison of Accepted Drug Registration Applications in 2009 and 2010

Conclusion

Without an analog to the FDA clinical trial database, the SFDA sometimes seems opaque. But the latest report shines a considerable amount of light on the agency's workings. Most importantly, it proves a robust level of activity in the new-to-China drug sector of China biopharma. That bears out the results shown by ChinaBio's research, as well. Now, without wishing to seem too impatient for the future, we would like to seem them break out data for Class 1 drugs as well.

Disclosure: none.

ChinaBio® News

Greg Scott Interviewed at BIO-Europe Spring

How to bring your China assets to China in 8 minutes

"Mr. Bio in China."

Mendelspod Interview

Multinational pharma held to a higher standard in China